National Construction Pipeline Report 2016 Released

Click here for more info

and to receive your copy

4th National Construction Pipeline Report 2016 – Building and construction industry continues to thrive

The National Construction Pipeline Report 2016 provides national and regional forecasts of activity in three categories; residential and non-residential building, and other types of construction such as roads and infrastructure, over a six-year period.

It is one of the few forecasts that compare its results to the previous forecasts, this adds reliability to the information provided and assists in constant improvement of the forecasts.

Data is collected in four regions Auckland, Canterbury, Waikato / Bay of Plenty and Wellington, with aggregated data provided for the rest of New Zealand.

The report is commissioned by the Ministry of Business, Innovation and Employment, and is jointly prepared by BRANZ and Pacifecon (NZ) Limited.

Click here to find out more and to receive your copy of the report and fact sheet

Newsletters

Subscribe to receive our regular newsletters to keep up to date with the news from Pacifecon

Login

Pacifecon - Building Intelligence Reports Available

» Market Watch *** available via subscription***

This report is produced monthly based on retrospective analysis of our data dynamics for the previous month. We focus on: new information, progression of existing projects, construction starting and cancellations. This data is presented by number of projects and value for both sectors and regions. Each month there is a focus on a different aspect of the Building and Construction industry. Contact us at projects@pacifecon.co.nz for a sample or to discuss.

» NEW Market Watch Auckland *** available via subscription ***

Focussing specifically on the busy Auckland market, this Market Watch style report also separates the RESIDENTIAL sector into single homes and multi-residential. Contact us at projects@pacifecon.co.nz for a sample or to discuss.

» Top 200 NZ Residential Builders *** latest report - available now ***

This report is based on Pacifecon’s own data, including: known planned projects and historical project information. The report is based on all building companies involved in residential projects, whether they are classed traditionally as a residential builder or not. Information is presented in three different ways. Builders with the highest…

- TOTAL VALUE of residential projects

- TOTAL NUMBER of residential projects

- AVERAGE $ VALUE of residential projects

Plus it includes a Residential Builders Directory. Contact us at projects@pacifecon.co.nz for a sample or to discuss.

» 2015 National Construction Pipeline report *** THIRD REPORT available now***

‘Having a clear view of projects in the pipeline across NZ provides greater certainty so both clients & the supply side of the construction industry can be prepared. It’s also important to highlight when & where major projects could be competing for resources’, says Chris Kane, Manager of MBIE’s Building and Construction Productivity Partnership.

See www.pacifecon.co.nz/news_pipeline_report.htm for fact sheet and download information.

Economic Outlook

According to the Outlook, both net migration and expenditure on the Canterbury earthquake rebuild is expected to slow gradually, slowing domestic demand and construction activity - projected to moderate to less than 3% in 2018. “The New Zealand economy is in good shape, which should provide a buffer against recent shocks," said NZIER senior economist Christina Leung.

Central Government

The Construction Industry is unlikely to see any revision in government policy. New PM Bill English, when asked if the Government would have a policy re-think over housing and the Government building more housing itself, said: "We will be doing a stock take, but the government is already pretty heavily involved and you will be seeing more rolling out over the next 12 months." He also commented, "In the coming months and years we will focus on building the roads, public transport, schools and houses to support a strong economy and growing population".

Whilst still Finance Minister Mr English launched an online portal aimed at giving a clearer picture of high-value infrastructure investments opportunities throughout Australasia. All projects are valued at over $100 million and have either recently started or are yet to get underway. This signals a joint commitment to building a more integrated infrastructure with Australia.

Infrastructure

Fletcher Construction chief executive Graham Darlow said, ”This is a boom and in my 40-year career I have never seen an opportunity like we have now and I have never seen the activity either.” Further, “ Sub-contractors are mainly owner operated business with relatively limited capability to recruit and train their people. It is important that we are bringing skilled labour into the country at the moment”.

NZ projects are now of sufficient scale and scope that world class engineers, quantity surveyors and others want to work on them. E.g. Sky City International Convention Centre, Commercial Bay, Auckland’s Waterview Connection: NZ's largest and most ambitious roading project so far.

Tourism

A joint tourism industry proposal to raise $130 million a year for public facilities that tourists use should include a $2 per night bed tax and include accommodation offered through the 'sharing economy' accommodation app Airbnb, says a recent Tourism Infrastructure Study. The report proposes that the tourism industry should raise $65 million in new revenues from the bed tax.

The levy proposal would help small communities swamped by the international tourism boom to provide sufficient basic infrastructure, including public toilets, car parks, and footpaths. Failure to provide such infrastructure will not only risk the quality of visitors' experience to New Zealand but also risks New Zealanders getting fed up with tourists.

Examples of places under pressure included Coromandel hotspots: Hahei and Cathedral Cove. Walkways and public spaces at Punakaiki Rocks on the West Coast and the Huka Falls near Taupo. As well as car parking and footpaths in downtown Queenstown.

While tourism is a major growth factor in the country's GDP, there is considerable pressure on tourist accommodation and, in particular, 4 and 5 star hotels. Several hotel developments are now planned or underway, and developers are seeking suitable sites for further projects.

After the 14 November magnitude 7.8 Quake:

The economy has largely escaped short-term fallout from the earthquakes; aftershocks and the possibility of heavy rainfall are the main concerns to ongoing repair work. Extra pressure will be put onto the nation's already stretched construction sector, says ASB chief economist Nick Tuffley. "So we can expect construction costs to be growing faster," said Tuffley.

A major cause of damage to commercial property buildings in the Kaikoura earthquake has been the failure to comply with non-structural, seismic restraint guidelines, the Insurance Council of New Zealand said. The restraints hold air conditioning structures, fire sprinklers, telecommunication and electricity systems, lighting and ceiling support systems. All of which can collapse and threaten life and property. "We believe many buildings have had these systems installed and do not comply with New Zealand standard guidelines for their installation," said chief executive Tim Grafton.

Wellington

17ha of Wellington CBD office floor space spread across 16 separate building have been closed to 50 tenants after November’s earthquake, experts say. Some buildings will be out of stock for a few weeks while others will be removed for more than six months

Wellington City Council has already ordered the destruction of one building on Molesworth St and the Reading Cinema carpark on Tory St.

Colliers International Wellington managing director Richard Findlay says “There is going to be a wider divide between quality stock and property that is not quite up to that standard,” Mr Findlay says it is difficult for tenants to find short-term space because landlords want leases for a minimum of six months. JLL’s COO Mark Grant believes rents will stabilise rather than rise significantly. The problem for most tenants is finding big pockets of space in the CBD. One side-effect of the earthquake is the halt in commercial property sales.

Kaikoura

Three new Bills were drafted in the wake of the earthquake to ensure the Government can enable affected communities to respond quickly and efficiently.

- The first Bill will bring forward the commencement date of most provisions of the recently enacted CDEMAA (Civil Defence Emergency Management Amendment Act). It also provides that a building owner may be required to undertake earthquake assessments of their properties.

- The second Bill – the Hurunui/Kaikoura Earthquakes Recovery (Emergency Relief) Bill 2016 – will temporarily increase timeframes in which someone can give notice or apply for retrospective consent in regard to emergency works under the Resource Management Act. It also proposes that emergency works to farm properties become permitted activities until 30 March 2017.

- The third Bill – the Hurunui/Kaikoura Earthquakes Recovery Bill 2016 – will establish a process that enables plans and bylaws to be amended by Order in Council.

SH 7, through the Lewis Pass, is now the main route from Picton to Christchurch. It has become congested and is showing signs of damage from the high volume of heavy traffic. It is estimated about 40 trucks a day normally use the route - now it is up to about 700.

Kiwi Rail started a coastal service from Auckland to Christchurch, buying capacity up to 3 times a week. Kiwi Rail CE Peter Reidy said it is too early to tell how long it will take to get the railway up and running. “We’ve got 85 bridges and 20 tunnels to inspect and we’ve inspected about 65% of those assets … I think we’ll have a better feel in 2 to 3 weeks.”

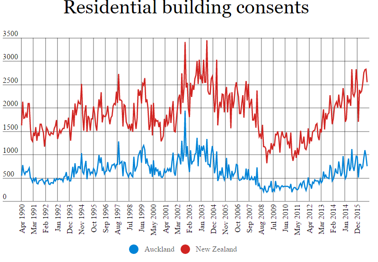

AUCKLAND – housing stays the focus

Auckland Mayor Phil Goff is setting up a housing task force to tackle supply and affordability issues in the city. The task force will examine all significant factors in the housing value and supply chain to identify barriers that might require Government and/or council intervention; ways to free up land, accelerate large-scale development, infrastructure funding, skill shortages, cost of building materials, ways to combat land banking and affordable housing. Auckland's Unitary Plan encouraging intensification is now operative.

With Auckland forecast to grow by a further 1 million people by 2046, electricity and gas distributor Vector says up to $1.8 billion must be invested in the coming decade to ensure the city's lights keep burning.

Vector is installing a Tesla Power pack battery system in Glen Innes providing commercial and household power on a grid-scale storage system.

The NZ Transport Agency has entered its second contract for a public-private partnership (PPP) to deliver a state highway, this time for the 18.5km extension of the northern motorway out of Auckland between Puhoi & Warkworth. The first PPP was for Transmission Gully in Wellington.

An unprecedented 47 cranes are now visible on the Auckland skyline pointing to a huge infrastructure spend and contributing to a bullish economic outlook for 2017.

Figures recently released by the Ministry of Business, Innovation and Employment estimated a $7.4 billion tourism spend in Auckland for the year to September 2016, a 9% increase on the year prior.

Some tourist developments planned:

- The Ritz-Carlton will open its first New Zealand hotel in Auckland in 2019.

- Auckland’s popular CBD Queen’s Head Tavern is to be converted into a 250-room hotel.

- Auckland's Harbour Bridge SkyPath cycling and walkway crossing gets resource consent.

- Glamuzina Architects have released details of a $250 million Karangahape Rd apartment, hotel and theatre project: ‘The McGregor’ has been proposed with air bridges linking to an existing apartment block.

- Demolition of Auckland's Downtown shopping centre is finishing and earthworks are beginning for the $850 million Commercial Bay office/shopping/dining precinct in the CBD.

- A giant $420 million 570-residence housing project launched: Sunny Heights is planned for a greenfield site on Sunny Heights Rd, Orewa.

- Funding issues have hit yet another big Auckland apartment project, the inner-city's planned St James Suites beside the historic Queen St theatre. St James' issues follow the cancellation of Avondale's big Flo apartment project

BAY OF PLENTY/WAIKATO/GISBORNE/HAWKES BAY/ROTORUA

The latest estimates from Statistics NZ showed Tauranga's population grew to 124,600 by the end of last year, up from 116,190 in 2013. Tauranga's influx included a significant number of foreign immigrants posing challenges for housing and infrastructure. Consents for residential building are up 46 % in the city. Shaky earthquake status has been revealed for 57 Tauranga buildings.

An affordable housing project set to provide 240 houses on Papamoa settlement land has been officially launched. The first stage of project was planned for early 2017 with a total of 110 sites.

The Waikato and Bay of Plenty may be on the cusp of a commercial property boom as increasing residential Auckland house prices continue rippling into the golden triangle, Infometrics senior economist Benje Patterson said.

Around $1.8 million will be invested to build a total of five new classrooms at schools in Gisborne and Hawke’s Bay, Education Minister Hekia Parata announced. “Like many parts of New Zealand, Gisborne and Hawke’s Bay are experiencing population growth. We’re committed to building new classrooms where this growth is having a flow-on effect on school rolls,” said Ms Parata.

WELLINGTON - earthquake shakes things up

Wellington’s dearth of available big office floors has become a major problem during the scramble by government departments and private businesses to find temporary space after the earthquake. Many buildings will need to be replaced, modified or reinforced. 554 buildings had been inspected (by 21 Nov). 27 had been given red stickers, which means they are unsafe to enter, and 66 yellow. Estimates for repairs vary from $3-5 billion.

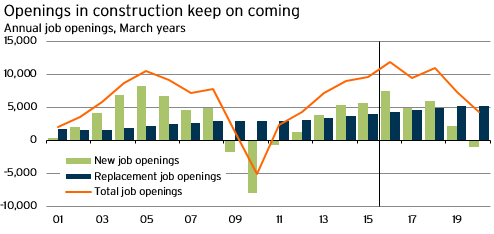

Demand created within the economy by Kaikoura earthquake-related rebuilding activities so soon after the Christchurch earthquakes and just as the Auckland Unitary Plan has come into full legal effect indicates prolonged boom and choking bottlenecks in the construction sector.

An Upper Hutt building company, Matrix Homes in Trentham, which already does modular housing is planning to build New Zealand's first modular high-rise. It is in talks with a developer for a 61-unit, inner-city apartment block in Wellington's Victoria St, which Matrix's managing director Sean Murrie says will probably be seven storeys tall. "While rising construction costs are not the only reason many construction projects aren't proceeding, clearly there is a need for greater innovation that will result in a less costly, faster and better performing built environment” said Murrie.

A new Five-star hotel complex is planned for Wellington; the complex comes as tourism numbers across the county continue to rise. Recent figures show room nights in September were up 6.4% on the same time last year to 2.6 million, a record across all accommodation types.

Wellington Chamber of Commerce chief executive John Milford referred recently to the capital’s city planning as “lacking grunt,” which is especially concerning as both resident, business and tourist numbers are expected to rise over the next decade. Commercial construction is also increasing, with non-residential building consents up 25% compared with 15% nationally in the September 2015 year.

Bayleys Research national manager Ian Little said more than $2.6 billion of new roading infrastructure will reinvigorate the Wellington region’s established industrial precincts and provide the catalyst for expansion of new precincts north of the city.

SOUTH ISLAND - The land of milk

South Island milk processor Synlait Milk has said it will spend a further $305 million on a capital expansion programme over the next three years including investing in a second site which should be identified by the end of the 2017 financial year. Fonterra’s has started construction on a new $240 million mozzarella plant at their Clandeboye site, making this the single largest foodservice investment in the history of New Zealand's dairy industry.

CHRISTCHURCH - HIGHLIGHTS

- A record 6.31 million passengers travelled in and out of Christchurch Airport in the 2016 financial year, up from 5.9 million in 2015 – the most passengers the airport has ever handled in a single year.

- Much work remains to be done in the Canterbury rebuild, particularly with regard to commercial and anchor projects, and the region remains positive.

- Rotorua company R & B Property Group has bought Verda Timber’s land and buildings from receivers and plans a major redevelopment into bulk retail.

- Five retailers open their doors in the new ANZ Centre, corner of Cashel and Colombo Streets.

- Minister for Science and Innovation, Steven Joyce announced a grant of up to $14.7 million over four years for the Centre for Space Science Technology.

OTAGO/SOUTHLAND

Otago's economic indicators are flattening, not because conditions are weakening but because they remain at elevated levels rather than continuing to rise.

The building boom in the region, driven by demand for holiday homes, investment properties and owner-occupied dwellings, continues unabated. There will be significant amounts of work for the construction sector which would face some of the challenges Auckland was having in attracting workers, given the increasingly high costs of living in the Queenstown area.

A new Queenstown retirement village has reversed the trend of operating as a “gated” facility and opened up to the local community. Coming at a time when Queenstown will go from having no retirement villages to two being built within 10 minutes of each other.

The Southland Regional Development Strategy was launched in Invercargill. Southland had laid out a clear and coherent plan to diversify the regional economy, grow the population by 10,000 by 2025 and strengthen local business. To help achieve those goals, the region had identified opportunities to grow sectors like tourism and international education.

Click here to see the latest Change to the Construction Contracts Act

Terms and Conditions

Last Updated: 8 June 2015

By entering our website client area via this login page you agree to the terms and conditions that are currently on this website.

They can be accessed via the Terms & Conditions link at the bottom of the page.